The Dorm Room Trader Who Built a $69 Billion Empire

The incredible journey of Ken Griffin the student who started trading in his small dorm and later made $69 billion empire

ORDINARY TO EXTRAORDINARYFINANCE

Thrive vision

11/15/20252 min read

The Dorm Room Trader Who Built a $69 Billion Empire

Most 19-year-olds spend their college years going to parties, cramming for exams, or figuring out their future.

But Ken Griffin was different.

While studying at Harvard, he wasn't thinking about college life. He was watching the stock market.

And he wasn’t just watching. He was trading.

From his dorm room.

A Satellite Dish on the Roof

In the late 1980s, real-time stock market data was not available online.

You needed:

Expensive terminals

Broker relationships

Or a satellite feed

Most students were trying to get posters or snacks in their dorms.

Ken Griffin convinced Harvard to let him install a satellite dish on the dorm roof just so he could track the markets live.

He turned his dorm room into a mini Wall Street desk.

The 1987 Crash When Fear Ruled. Then came the 1987 market crash, referred to as Black Monday.

The world panicked.

Markets fell apart.

Investors froze.

But Ken didn’t.

Where others saw chaos, he saw opportunity.

He began trading in convertible bonds-a niche, complex nook and cranny of finance that most people ignored.

And he started making real money.

Raising Capital From Anyone Who Believed

But he needed larger capital to expand.

So he raised money from:

Family

Friends

A neighbor

And yes… even his dentist

Anything to get started.

He did not wait for approval.

He built belief, one person at a time.

By the time he graduated from Harvard, he wasn't leaving school looking for a job.

He was already handling over $1 million.

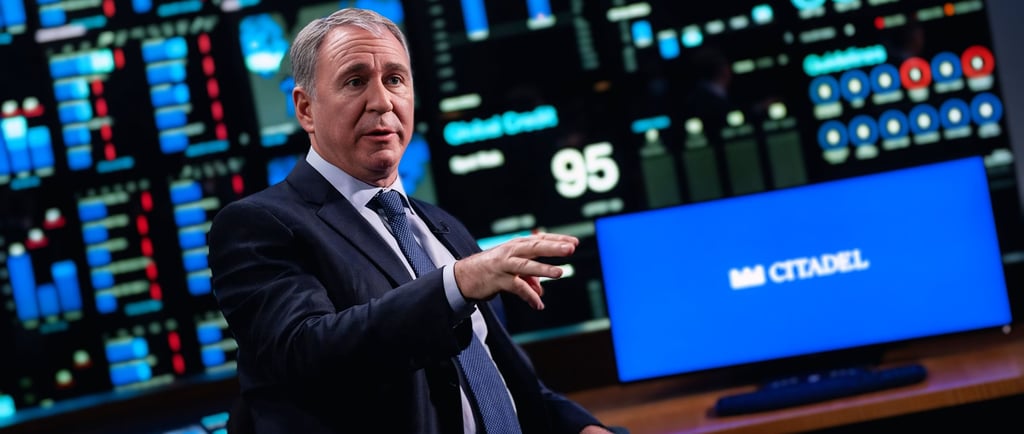

Citadel Was Born

In 1990, when he was just 22 years old, Ken Griffin founded Citadel with $4.6 million under management.

No fancy office.

No billion-dollar backing.

Just strategy, discipline, and relentless execution.

And then the growth started.

Citadel became known for:

Unparalleled risk management

Data-driven trading

Advanced algorithms

Recruiting top minds in math, physics, and engineering.

While traditional firms moved slowly, Citadel moved at the speed of data.

From Dorm Room to Market Powerhouse

Today, Citadel manages more than $69 billion.

Yes — $69 billion

One of the largest hedge funds on Earth.

And Citadel Securities?

It processes close to 40% of all U.S. stock market orders, more than any bank or Wall Street giant.

From a dorm-room satellite dish to shaping global finance.

What makes his story different?

Ken Griffin didn't:

Come from a rich financial dynasty.

Work through corporate ladders for decades.

Wait for the “right time”

Permission

He built his path, starting with:

A $200 satellite dish

A dorm room desk

And a belief that information = opportunity

His Lesson to the World

Success is not about resources. It's about resourcefulness.

He didn’t have any access to Wall Street, so he built a Wall Street, all his own, inside of a dorm room.

He didn't wait for a chance. He made one.

Takeaway Every empire starts as a small, unreasonable idea. One dorm room One satellite dish One teenager who refused to think small Today, Citadel is a financial titan. But it started the same way every dream starts: With someone who believed when no one else would.

Inspiration

Explore success stories and motivational journeys today.

Growth

Vision

© 2025. All rights reserved.